Digital Banking Research: It’s More Than UX Testing

Many industry experts predict that banking is becoming a digital-first customer experience. That means digital solutions need to become much, much more than simple alternatives to manual banking transactions. And they’ll need to be seamlessly integrated as part of an omnichannel strategy.

Digital banking research uncovers the “unicorn” insights you need to understand (and leverage) interrelated banking experiences across the customer journey. Armed with that knowledge, you can optimize your digital experiences to effectively enhance CX, strengthen brand relationships, and build brand loyalty in a chaotically competative market.

Going Beyond UX Testing

Ensuring your digital offerings meet customer needs and are easy to use will always be table stakes. That’s where UX testing is most effective. However, evaluating the customer’s digital tool interactions via UX testing only goes so far.

Gaining insight into how digital experiences fit within overall CX requires a more holistic research approach. For example, measuring aspects of digital tool satisfaction within the context of a broader CX and/or BX research framework. This leads to a deeper understanding of the relative influence various channel experiences have on CX.

Research findings can also shed light on which aspects of the digital experience have the greatest impact on satisfaction, such as overall perceptions, functionality, or level of personal interaction. That knowledge will help you pinpoint where to focus your efforts to effectively drive overall CX enhancements.

It’s also important to collect employee feedback, particularly among those on the frontline. This is a valuable way to identify influences on the quality of customer digital experiences. For instance, you might find opportunities to improve familiarity with the breadth of your digital solutions, which customer needs they fulfill, or the functionality of specific tools. Knowledge gaps in areas like these can greatly impact an employee’s ability to quickly resolve customer problems and frustrations.

Ways to Measure the Impact of Digital Interactions on CX

There are many ways marketing research can help identify opportunities to not only enhance digital solutions, but also discover unmet or emerging needs. Here are five approaches to consider.

- Co-Creation: Collaborate with customers to create and refine digital tools, services, and means of communication.

- EX Research: Learn directly from frontline employees about the types of customer questions and problems they deal with and hear what challenges or barriers may be preventing them from helping to quickly resolve issues.

- Online Communities: Gather feedback to better understand pain points in the customer journey and explore ways new digital experiences could resolve those problems.

- Social Media Listening: Monitor sentiment analysis and volume of discussion on usage of your bank’s digital solutions, those of competitors, as well as usage of digital solutions in other industries.

- Tracking Research:

-

- Digital Tracking: Measure usage and satisfaction with specific digital tools to assess the impact on key metrics like overall customer satisfaction and likelihood to recommend.

- CX Tracking: Understand the impact that various interactions have on overall experiences and if there are friction points in achieving a digital-first strategy.

- Competitive Position: Monitor the effectiveness of digital experience improvements to differentiate the brand and eliminate perceptual advantages of competitors’ digital solutions.

Turn Your Research Insights into Strategic Advantages

The true value of generating digital banking research insights lies in the way it can guide CX strategies to help customers improve their financial well-being. Here are two examples of banks who have successfully designed digital experiences that empower customers to achieve their financial goals.

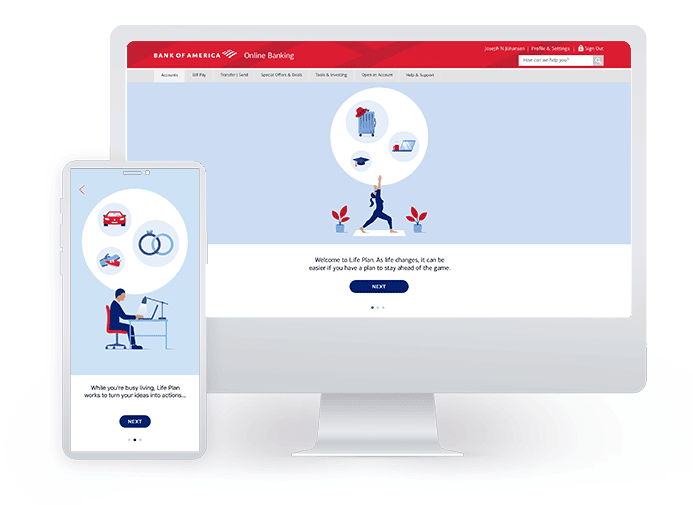

Bank of America

- Better Money Habits – Online financial guidance content hub

- Life plan – Digital financial management platform

- Erica – Digital assistant providing advice

Capital One

- CreditWise – Mobile app monitoring credit and setting savings goals

- Eno – Digital assistant providing advice

“Customers rate Bank of America and Capital One the strongest at helping them make better decisions, manage their spending, meet their savings goals, and meet their credit and borrowing needs. This is a result of a clear strategy, at both banks, of advancing digital transformation beyond transactions into essential customer journeys, including improving consumers’ financial health.”

Optimizing Digital Experiences to Enhance CX

Banking is fast becoming a digital-first customer experience. Elevating CX by optimizing your customers’ digital experiences across their entire journey can also help differentiate your financial institution and stave off competitive threats. Marketing research can support that effort by helping banks understand the ways that digital interactions are either enhancing or diminishing CX.

RECOMMENDED FOR YOU

Bank Switching Is Easier than Ever, So How Do You Make Customers Stick?